In this article, I am going to focus on condominiums and their pros and cons. To start, the term “condominium” in the strictest sense refers to the type of ownership, not the type of building. This is a common source of confusion, which I will try to clarify. Here is the definition of “condominium” from Investopedia.com:

A condo, short for condominium, is an individually owned residential unit in a building or complex comprised of other residential units. Condo owners share a common space and often pay association fees to maintain the common space, amenities, and other shared resources.

So a condo is a hybrid type of ownership [I said home ownership earlier, but condos can be commercial also.] that combines individual ownerships of the unit with shared ownership and maintenance of common areas. Two common misconceptions about condominiums are:

- They are luxury housing.

- They are always vertically stacked apartments.

I will explain these briefly before moving onto discussing about the pros and cons of condos.

Condos Do Not Mean Luxuries

First, the idea that condos are luxury housing likely arose due to their prevalence in more expensive cities.

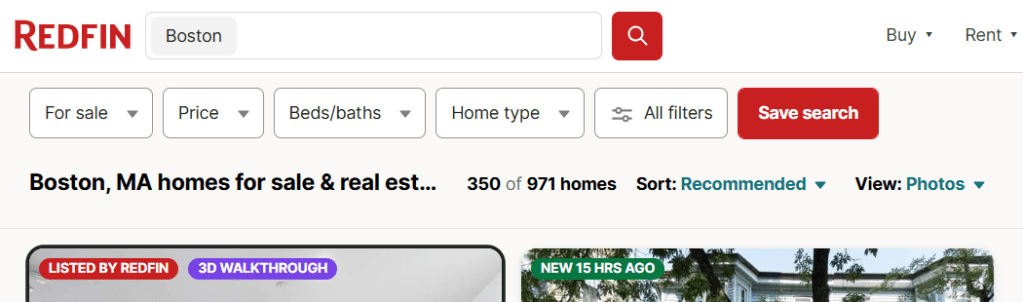

On 1/12/2025, the day I started writing this article, Redfin.com showed me that there are 971 homes listed for sale in Boston. It has about 654,000 people and is the capital of the state of Massachusetts.

You can use the “Home type” dropdown to filter by the home type. Of those, 93 were “homes”, meaning single-family homes. They are less than 10% of the listings. That does not include townhouses, which are single-family homes with shared party walls on either sides. In some professional documents, they are called “attached single-family homes” as opposed to “detached single-family homes” which most of us just simply call “single-family homes.”

The remaining breakdown in Boston goes as follows. Interestingly, even real estate websites mix up the types of ownerships with the types of buildings:

- Townhouses: 55 units.

- Condos: 350 units. That is 36% of the 971 listings. Most, but not all of them, are the vertically stacked multi-family apartment buildings people are familiar with when they hear “condos.”

- “Multi-Family”: 108 units. They are specifically referring to a smaller multi-family building like a duplex or a triplex that is owned by one person or a company. The owners are typically non-resident investors, but you also have resident-owners who live in one unit and rent out the other. And in some cases, multi-generational families jointly own and live together in a building.

- Co-op: 6 units. This refers to another type of multi-family ownership that is different from condos. It is common in New York City. From Rocket Mortgage: “When you buy into a co-op, you’re not purchasing a piece of property or unit in a building. You’re buying shares in the nonprofit corporation that owns the building. You’ll receive stock instead of a title as you would with a traditional home purchase.” I know anecdotally that these are hard to get loans than condominiums. I am not familiar with them and will not cover them in this article.

- Land, Mobile Homes, Other: These three types compose 33 listings. I won’t go into them here.

Boston has a very expensive housing market where the median home sale price is $898,500 according to the same site. That likely is the major factor for the prevalence of multi-families over single-families, which is less than 10% of the listings. Basically, most people cannot afford single-family homes which require each unit owner to pay for the whole price of the underlying land. More on this later.

That dynamic is flipped when you go to Leominster, MA, a city of about 46,000 people 45 miles northwest of Boston. Their Redfin listings show 30 homes total, and of those, there are 16 single-family homes, which is more than 50%. Their median sales price is $470,000, still pretty expensive but nothing like Boston’s.

The idea that condos are luxury housing because they are popular in expensive cities is confounding the sequence of events. We need to look into the term, “expensive cities.” In this case, it refers to cities with lots of jobs and amenities, which leads to high demand and high land prices. Multi-family homes in such cities are more common due to them being cheaper to build per unit than single-family homes on expensive pieces of land. The basic math goes:

Cost of One Unit = (Total Cost of Development + Cost of Land) / (Number of Units)

In cities with high land costs, it makes sense to build more units even if the total cost is higher since the per unit cost goes down and you can attract more buyers. Looking at this math, condominiums are not luxury housing but the opposite. Some condominiums might add nice amenities and even call themselves “luxury.” This condominium building in New York City claims to “redefine modern urban luxury.” Its starting price for a two-bedroom is $2.295 million. This is not an unusual price in New York City.

However, if you are extremely wealthy in an expensive city, you likely would own a single-family home, not a unit in a multi-family building. An extreme example of a single-family home in an expensive city is Antilla, the multi-billion dollar home of Indian billionaire Mukesh Ambani in Mumbai. Now, that is a generalization since even wealthy people often like to live in condominiums due to the communities and amenities they provide. Anecdotally, I know of wealthy people who own multiple homes – condominiums in dense and expensive cities and a single-family home or two for vacation in less dense cities. I guess a more accurate explanation would be wealthy people like owning all kinds of homes.

Not All Condos Are Apartments

The second misconception to address is that condominiums are always stacked apartments. Let me remind you the definition of condominiums above, “Condo owners share a common space and often pay association fees to maintain the common space, amenities, and other shared resources.”

If you are building a stacked multi-family building where each person owns a unit, due to the necessary common vertical spaces such as staircases and hallways, you have to organize them as condominiums.

If you are building a complex of single-family homes on a large plot of land, even if they do not share any vertical spaces, they still have common areas such as driveways and parking spaces. That means you still have to organize them as condominiums or co-ops in most cases. Go around and look for a complex of single-family homes, gated or ungated, with shared maintenance in your area. You will likely find out that many are organized as condos. Also, cohousing, a type of a community where owners or renters share a common house for socializing are usually organized as condominiums. Cohousing owners do not go out and advertise their units as condos. I suspect the reason is that the term “condos” sounds so materialistic and does not jive with the idealisms of cohousing. Legally, though, it fits almost perfectly – individual ownership of units combined with shared ownership of common areas, including the common house.

Now let’s go into the fun part, the pros and cons of condos.

Pros and Cons of Condos

As you might have guessed even if you never lived in a condo or rented an apartment, the shared ownership aspect of condominiums brings various social and financial complications. A condo complex might add lots of amenities and even call itself luxury like the example above, but at the end of the day, people are sharing resources to save on costs. People have to make decisions on maintenance and finances as a community. If you are an outsider looking in, that is where the fun begins. If you are a part of the condo complex, that is where the pain begins. Without going into details, I grew up in a South Korean condo and briefly owned a condo unit, so I can talk about it from lived experiences.

Let’s throw in some fun hypothetical examples of complications.

- You are living in a building with vertically stacked units. The neighbor upstairs has a leak that damages your unit. Whose fault is it? And how do you make the person at fault pay?

- Your neighbors are loud/impolite/smoke a lot/keep rotting food. How do you address it?

- Your building has serious deferred maintenance issues but the majority of the owners do not want to pay for repairs due to the lack of money or wanting to save money. In extreme cases, these issues lead to building collapses like the one I covered in another article.

- Your complex does not have regulations against too many investor-owners who do not live in the condo complex but rent out the units for income. Most of the day-to-day upkeep falls to resident-owners. Also, since the Federal Housing Authority, who offers more favorable mortgages, “require[s] that approved condominium projects have a minimum of 50 percent of the units occupied by owners for most projects,” potential buyers would have more trouble getting loans, making the units harder to sell.

- Based on a true story, not mine: You live in a complex of mostly wealthy retirees where it is trendy to say, “We are going to die soon, so let’s live it up.” They push for expensive aesthetic upgrades and have the majority vote. Because you can’t afford the increased monthly fees or don’t want to, you sell and move on.

- You live in a townhouse condo (side-by-side single-family homes sharing common side walls) where most of the roof damage from wear-and-tear occurs on your home. Even though the condominium bylaw says roof maintenance is a shared responsibility, your neighbors insist that only you should pay for the roof damage.

- Massachusetts General Law’s Chapter 183A covers condominiums. In section 19 of the chapter is the statute that allows for a deconversion with a 75% vote of the unit owners. More than 75% of the unit owners decides to de-convert the condominium complex and sell it whole to an investor who will turn them into rental apartments. You are in the minority that opposed. You now have a choice to make: 1) Stay and pay rent for the unit you used to own; or, 2) Take the money and move.

- This dilemma is more complex because sometimes, the complex is in such bad physical or financial condition (or both) that it makes more sense for the owners to sell it to an investor who can repair the complex and find another place to live.

- In other cases, you have a complex that is dominated by investor-owners, who are focused on the complex as an investment rather than housing. Their goal is to maximize profits even if the complex is in good shape and others want to stay as resident-owners.

It was not my intent to write a horror novel but to alert people to real-life complications that will likely become more common. Throughout the United States, zoning changes allowing for more multi-family homes are happening to deal with the housing crisis. While many of these buildings will be rentals, others will be condominiums owned by residents and investors. In more expensive cities, condominiums are already one of the few possible forms of home ownership for the majority except for the very wealthy. In less expensive cities where single-family homes are dominant, condominiums are often geared for people with low-income who cannot afford single-family homes. Combine the examples of complications I listed above with unit owners who do not have much money for maintenance, and you can imagine how the complications can compound.

To end this article on a positive note, condominiums have the potential to magnify the positive aspects of community. This applies to multi-family homes in general regardless of the ownership type. Humans are social beings that enjoy living in communities. What people often miss when focusing on condominiums as a more affordable type of home ownership is the built-in community aspect that sets them apart from owning single-family homes. In the next article in this series, I am going to share some rough thoughts on improving the mental (the bylaws, the culture, and the financial) and physical aspects of condominiums to make them into a more attractive type of home ownership than they often are in the present.

For Further Reading

As you might have guessed, government workers rarely use Redfin.com for research. They often turn to the federal Census data, which are complicated to navigate. In this article, I used Redfin.com to make a point in a more accessible way. If you are interested in the type of data that government employees use and do not mind going down a rabbit hole, here is a link to a Census table that lists different types of housing for the entire United States: https://data.census.gov/table/ACSDT5Y2023.B25136?q=occupied%20housing.

You will notice the term American Community Survey, or ACS. It’s a much more frequently collected type of data than the Decennial Census many are familiar with. You can use the Geos button to narrow down to the desired state or municipality. When you click the Dataset button, you will notice that it will give you options for choosing a 5-year dataset or a 1-year dataset. For smaller regions, the data are collected over a five-year period for each dataset, which makes it less current but also less subject to volatility. For larger regions, the data are collected both over a one-year period and a five-year period. The one-year period dataset is more subject to volatility but also more current.

The Census data are complex as you can see. Also, I am aware of a programmatic way to access and process a large amount of data using the “Application Programming Interface” (API), but I myself do not know how to do that. I am giving you a surface view of what kind of data the government collects to help make policy decisions that affect our daily lives.